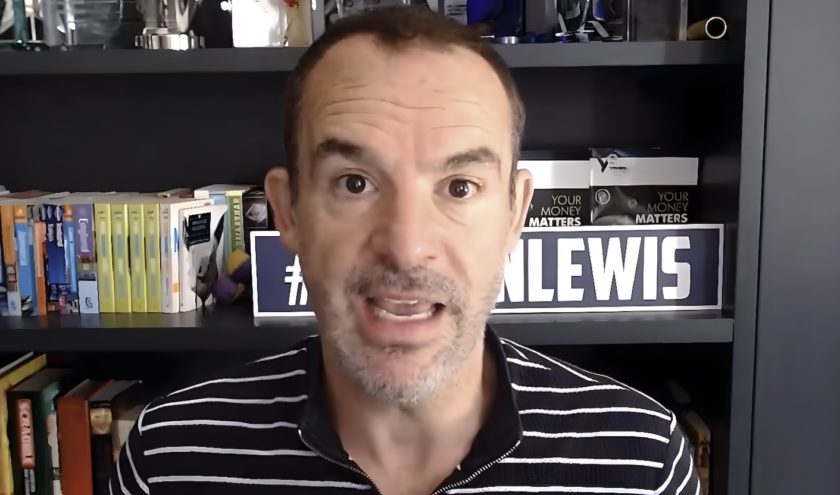

Martin Lewis issues “urgent warning” after Bank of England holds base rate at 5.25%

The Bank of England’s decision to maintain the base interest rate at 5.25% has spurred Martin Lewis, finance guru and founder of MoneySavingExpert.com to issue an “urgent warning” for UK savers.

He advises those contemplating fixed-rate savings accounts to make a move “this minute,” cautioning that rates could see a decline as early as today or later this week.

For 14 consecutive months, interest rates have seen a steady rise.

Thursday’s announcement by the Bank of England to keep rates unchanged marks a departure from a long-standing trend.

The base rate is critical; it serves as the rate at which the central bank charges other financial institutions for borrowing money.

This, in turn, influences the rates for both savers and borrowers across the nation.

Martin Lewis, whose financial advice has guided countless Britons through the complexities of personal finance, expressed his immediate reaction: “It’s therefore possible fixed-rate savings providers may shave down their rates at speed (as they’re based on longer-term predictions of interest rates).”

Lewis proposes a tactical approach for those who are uncertain: Open a fixed-rate account today but hold off on funding it. This offers you the flexibility of a seven to 14-day window to see how rates will fare. Should rates swing the other way, you can choose not to fund the account you’ve just opened.

Lewis also touched on a topic that affects a large segment of the population: mortgages. He indicated that, like the savings accounts, new mortgage fixed-rate deals might also see adjustments. They could potentially drop over the next few days as they are also influenced by long-term rate predictions.

In a Nutshell

The Bank of England’s decision has ramifications beyond Wall Street and The City. It trickles down to the average saver and homeowner. Lewis’s urgent advice underscores the need to stay informed and make swift decisions when it comes to your financial portfolio.

Martin Lewis’s complete rundown of top rates and further advice can be found on the MoneySavingExpert.com’s guide to top savings accounts.

While the interest rate scene remains fluid, one thing is certain: a proactive approach to your savings and mortgage could make all the difference in these uncertain times.

MoneySavingExpert.com is part of the Ewloe-based Moneysupermarket.com group.

Spotted something? Got a story? Send a Facebook Message | A direct message on Twitter | Email: [email protected]Latest News