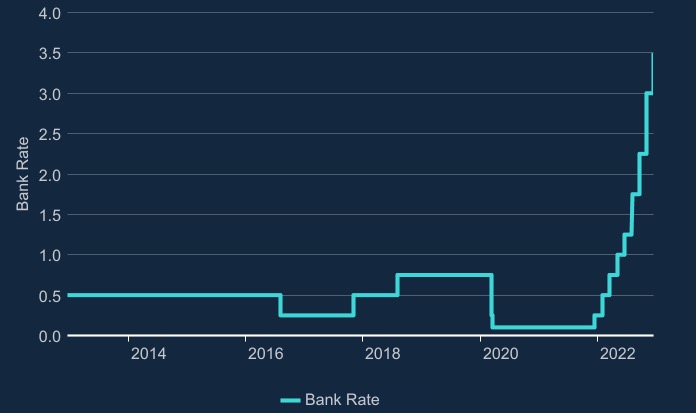

Bank of England base rate up to 3.5%

The Bank of England (BoE) has hiked interest rates to 3.5% from 3% – the highest level in 14 years.

Bank Rate is the single most important interest rate in the UK. In the news, it’s sometimes called the ‘Bank of England base rate’ or even just ‘the interest rate’.

The BoE’s Monetary Policy Committee (MPC) sets Bank Rate as part of the Monetary Policy action they take to meet the target that the UK Government sets them to keep inflation low and stable.

If Bank Rate changes, then normally banks change their interest rates on saving and borrowing. But Bank Rate isn’t the only thing that affects interest rates on saving and borrowing.

In a statement the BoE have explained, “The Committee has voted to increase Bank Rate by 0.5 percentage points, to 3.5%, at this meeting. The labour market remains tight and there has been evidence of inflationary pressures in domestic prices and wages that could indicate greater persistence and thus justifies a further forceful monetary policy response.

“The majority of the Committee judges that, should the economy evolve broadly in line with the November Monetary Policy Report projections, further increases in Bank Rate may be required for a sustainable return of inflation to target.

“There are considerable uncertainties around the outlook. The Committee continues to judge that, if the outlook suggests more persistent inflationary pressures, it will respond forcefully, as necessary.

“The MPC will take the actions necessary to return inflation to the 2% target sustainably in the medium term, in line with its remit. The Committee will, as always, consider and decide the appropriate level of Bank Rate at each meeting.”

The full BoE statement is below….

The Bank of England’s Monetary Policy Committee (MPC) sets monetary policy to meet the 2% inflation target, and in a way that helps to sustain growth and employment. At its meeting ending on 14 December 2022, the MPC voted by a majority of 6-3 to increase Bank Rate by 0.5 percentage points, to 3.5%. Two members preferred to maintain Bank Rate at 3%, and one member preferred to increase Bank Rate by 0.75 percentage points, to 3.75%.

In the MPC’s November Monetary Policy Report projections, conditioned on the elevated path of market interest rates at that time, the UK economy was expected to be in recession for a prolonged period and CPI inflation was expected to remain very high in the near term. Inflation was expected to fall sharply from mid-2023, to some way below the 2% target in years two and three of the projection. This reflected a negative contribution from energy prices, as well as the emergence of an increasing degree of economic slack and a steadily rising unemployment rate. The risks around that declining path for inflation were judged to be to the upside.

Domestic wage and price pressures are elevated. There has been limited news in other domestic and global economic data relative to the November Report projections.

Most indicators of global supply chain bottlenecks have eased, but global inflationary pressures remain elevated. Advanced-economy government bond yields have fallen, particularly at longer maturities. The sterling effective exchange rate has appreciated by around 2¾%. There has been some reduction in UK fixed-term mortgage rates since the Committee’s previous meeting, but rates remain materially higher than in the summer.

Bank staff now expect UK GDP to decline by 0.1% in 2022 Q4, 0.2 percentage points stronger than expected in the November Report. Household consumption remains weak and most housing market indicators have continued to soften. Surveys of investment intentions have also weakened further.

Although labour demand has begun to ease, the labour market remains tight. The unemployment rate rose slightly to 3.7% in the three months to October. Vacancies have fallen back, but the vacancies-to-unemployment ratio remains at a very elevated level. Annual growth of private sector regular pay picked up further in the three months to October, to 6.9%, 0.5 percentage points stronger than the expectation at the time of the November Report.

Twelve-month CPI inflation fell from 11.1% in October to 10.7% in November. The November figure was slightly below expectations at the time of the November Report. The exchange of open letters between the Governor and the Chancellor of the Exchequer is being published alongside this monetary policy announcement. Although the introduction of the Energy Price Guarantee (EPG) in October has limited the rise in CPI inflation, the contribution of household energy bills to inflation has risen further. Since the MPC’s previous meeting, core goods price inflation has fallen back, while annual food and services price inflation have strengthened. CPI inflation is expected to continue to fall gradually over the first quarter of 2023, as earlier increases in energy and other goods prices drop out of the annual comparison.

The announcement in the Autumn Statement that the extension of the EPG will cap household unit energy prices at a level consistent with a typical household dual fuel bill of £3,000 per year from April 2023 to March 2024 implies a slightly lower near-term path for energy bills than the working assumption made in the November Report. All else equal, this will reduce the MPC’s forecast for CPI inflation in 2023 Q2 by around ¾ of a percentage point.

Other additional near-term fiscal support was also announced in the Autumn Statement, but fiscal policy is expected to tighten by progressively larger amounts from fiscal year 2024-25 onwards. Overall, Bank staff estimate that these measures, combined with the impact of the EPG, will increase the level of GDP by 0.4% at a one-year horizon, leave it broadly unchanged at a two-year horizon, but reduce the level of GDP by 0.5% in three years’ time, relative to what was assumed in the November Report. The overall impact on the CPI inflation projection at all of these horizons is estimated to be small.

The MPC’s remit is clear that the inflation target applies at all times, reflecting the primacy of price stability in the UK monetary policy framework. The framework recognises that there will be occasions when inflation will depart from the target as a result of shocks and disturbances. The economy has been subject to a succession of very large shocks. Monetary policy will ensure that, as the adjustment to these shocks continues, CPI inflation will return to the 2% target sustainably in the medium term. Monetary policy is also acting to ensure that longer-term inflation expectations are anchored at the 2% target.

The Committee has voted to increase Bank Rate by 0.5 percentage points, to 3.5%, at this meeting. The labour market remains tight and there has been evidence of inflationary pressures in domestic prices and wages that could indicate greater persistence and thus justifies a further forceful monetary policy response.

The majority of the Committee judges that, should the economy evolve broadly in line with the November Monetary Policy Report projections, further increases in Bank Rate may be required for a sustainable return of inflation to target.

There are considerable uncertainties around the outlook. The Committee continues to judge that, if the outlook suggests more persistent inflationary pressures, it will respond forcefully, as necessary.

The MPC will take the actions necessary to return inflation to the 2% target sustainably in the medium term, in line with its remit. The Committee will, as always, consider and decide the appropriate level of Bank Rate at each meeting.

Spotted something? Got a story? Email: [email protected]

Latest News